₹50 Lakh Cyber Fraud The Largest Cyber Fraud Settlement in ICICI Lombard’s History

₹50 lakh Cyber Fraud, the largest settlement in ICICI Lombard’s history. An experienced doctor, working at the frontline of critical care, found himself battling not a disease but deception. In a matter of hours, he was cornered, isolated, and defrauded of ₹80 lakhs by a group of cybercriminals who didn’t use force or hacking tools but the language of fear, legal jargon, and institutional power. It was a masterclass in psychological manipulation, one that exploited not just trust but also silence, shame, and panic. What followed wasn’t just a claim process; it was a four-month confrontation with policy, system limitations, and bureaucracy. And at the end of it stood a number: ₹50,00,000. Fully recovered without any deductions or compromises. A first-of-its-kind win in the cyber insurance space.

Case Background

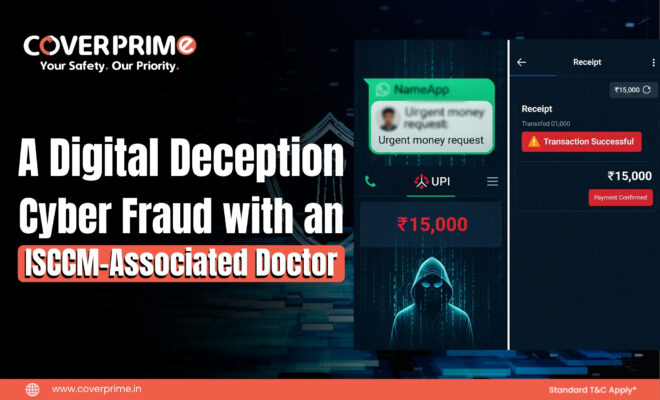

January 17, 2025. A Hyderabad-based doctor received a call from someone claiming to be part of the Mumbai Cyber Crime Police. The voice on the other end was calm, professional, and unnervingly precise. The accusation was sharp: the doctor’s Aadhaar was linked to a financial scam involving a well-known businessman. An arrest order was said to be underway. Within minutes, he was transferred to a so-called “senior officer” who continued the conversation over WhatsApp for “confidentiality.”

Documents started to arrive. A forged arrest warrant and a fake CBI notice. Screenshots showing a Canara Bank account in his name allegedly used for laundering funds. Another impersonator posing as an RBI officer joined the conversation. The script escalated: three to five years of jail, public defamation, and asset seizure. All threats were legal-sounding, cold, and relentless. There was no malware or phishing links, all just pressure. Constant, calculated pressure.

The doctor was told to prove his innocence by cooperating. That meant sharing his Aadhaar card, disclosing bank accounts, and eventually, transferring his entire account balance of ₹80 lakhs to a so-called “RBI verification account” that would ‘audit and return’ the funds. He obeyed, and by nightfall, the money was gone.

Incident Report

The cyber fraud was executed with the precision of a staged interrogation. The doctor wasn’t duped by a single message or a link, but by a full-length performance. Voices overlapped, Identities shifted, Pressure was applied strategically just enough to prevent pause, but not enough to feel fake. The visuals were official-looking PDFs. The tone was procedural, legal, and dry. The conversation moved from alarm to urgency to compliance, all while isolating the victim from any external verification. He never got time to call a lawyer, or a colleague, and even question if any of it was real.

He transferred his life savings because the cyber fraud threats felt bigger than the money. And in the language of fear, ₹80 lakhs became a small price for safety

Claim Challenges

The doctor reported the cyber fraud incident to CoverPrime nearly a month later, on February 16, 2025. By then, many critical documents had been deleted in panic, and no official FIR had been filed. As expected, the claim was rejected. Not once, but multiple times. The insurer cited delay in intimation, lack of primary proof, and exclusions related to “social engineering fraud,” a term often used to distance insurers from human error. Initial settlement discussions didn’t go beyond ₹28 – 35 lakhs, with deductions proposed for every gap in the paper trail.

CoverPrime’s Role

Rules didn’t favour the insured. But the truth did. From the first call, it was clear that the fraud wasn’t a mistake; it was a trap. And CoverPrime decided not to process the case like another claim, but to pursue it as a case of criminal victimization. A legal team was looped in, and the call records were reviewed. Psychological evaluations were submitted to explain the delayed response. Each deduction raised by ICICI Lombard was answered not just with documents, but with context. What began as a technical rejection turned into a legal escalation, arguing not for an exception, but for justice.

Every week brought another pushback, another round of negotiations, and another attempt to close the case at a lower figure. And every week, the team pushed back harder. Senior leadership was engaged. Brokers, lawyers, and analysts all focused on one goal: a full, fair settlement.

Final Outcome

On July 23, 2025, after four months of negotiation, ICICI Lombard released the entire insured sum of ₹50,00,000 with no deductions, no penalty, and no compromise. It became the largest cyber insurance payout ever settled by ICICI Lombard through a broker, setting a benchmark not just in value, but in principle.

Conclusion

In most fraud cases, especially those involving human judgment, policy clauses win. This time, persistence did. The recovery of ₹50 lakhs wasn’t just a financial win; it was a reminder that not all claims are technical. Some are human, and when truth is fought for relentlessly, it becomes undeniable.

Disclaimer: All personal and identifying details in this case study have been anonymized by data protection and confidentiality norms.