Wrong Eye, Wrong File, and Almost No Refund!

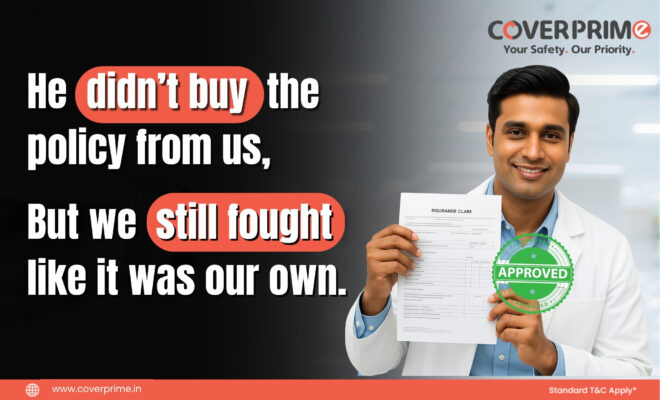

This case study reveals the behind-the-scenes story of how a small paperwork error nearly cost a Mumbai-based dentist’s father a rightful insurance claim. Despite not buying the health insurance policy from us, the doctor, a CoverPrime Protect+ member, turned to us for help and found much more than he expected.

Case Background

In April 2025, Doctor’s father underwent eye surgery. But what should’ve been a routine reimbursement turned into a bureaucratic nightmare when the insurance company rejected the claim outright. Why? Because medical records mistakenly reflected surgery on the right eye, while the actual procedure had been done on the left eye. Frustrated and anxious, the doctor reached out to CoverPrime not for blame, but for solutions, and we delivered.

Incident Report

1: Date of Incident: 21 April 2025, the insurer rejected the claim for Doctor’s father’s eye surgery due to mismatched documentation, the wrong eye was mentioned in the submitted files.

2: First Contact with CoverPrime: 22 April 2025, the doctor contacted our team seeking consultation, escalation support, and clarity on next steps.

3: Doctor’s Concern: He was worried about losing the entire claim and wanted to understand how to escalate the issue, especially since the policy wasn’t even purchased through us.

4: Internal Support Initiated: Our in-house health claims expert contacted him and reviewed the case in detail.

5: Escalation & Coordination: While guiding the Doctor to explore the Ombudsman route, we coordinated internally with the insurance company and escalated the matter to their underwriter.

6: Corrective Action: Fresh documents were submitted mentioning the correct eye. Within days, the claim was reopened and approved, without the need for legal intervention.

Support from CoverPrime

1: Claim Review & Clarity: Even though the health policy wasn’t ours, we took full ownership of consultation and action, proving our commitment beyond product boundaries.

2: Expert Consultation: Our health claims expert worked one-on-one with the doctor to identify the error and prepare the right documentation.

3: Insurer Coordination: We handled backend conversations with the insurance brand, ensuring the doctor didn’t have to chase emails or sit through call centre loops.

4: Zero Legal Hassle: CoverPrime’s prompt internal escalation, the ₹34,000 refund was processed without any litigation or court battle.

5: Reputation Reaffirmed: Doctor personally acknowledged that without our intervention, the claim would have likely remained rejected, causing emotional and financial stress to his family.

Conclusion

A single typo nearly derailed a deserving health claim. But what stood out wasn’t just the correction, it was the commitment to help, even without obligation. At CoverPrime, we don’t just cover doctor, we stand by their families too. This case is a powerful reminder that when things go wrong, the right partner makes all the difference.

Disclaimer:

The data in this case study has been anonymized to protect client privacy. Any resemblance to real persons is purely coincidental.